![]()

The current date will default. This date can be changed so that the value is added to the correct month.

Equipment Inventory Life Cycle

This option is designed to setup the equipment record whether or not the actual equipment invoice has been received or the item has been received.

Select Equipment Inventory Menu>>Processing >>Equipment Receipting

Enter the General Ledger posting date

|

The current date will default. This date can be changed so that the value is added to the correct month.

|

Select the option to use for entering the item into inventory:

Choose Equipment Receipt Option I - Immediate Cash Disbursement S - Short Term Liability - Accounts Payable |

NOTE: Normal entries are entered as a positive amount, if you need to make an adjustment you can enter the amount as a negative. You may also arrow to the description field and modify the description to suit your entry.

I - Immediate Cash Disbursement

Complete this screen. (Click on a field name for an overview. An asterisk (*) denotes required fields.)

Select ENTER or the post F10 to save and post entries.

This program will update the book cost value of the equipment and generate a check to pay for it. There will be NO amount in the flooring field on the piece of equipment. When the equipment is sold that book cost value will then be zeroed out.

Once all items are entered, press F9 to exit.

S - Short Term Liability - Accounts Payable

Complete this screen. (Click on a field name for an overview. An asterisk (*) denotes required fields.)

Select ENTER or F10 to save and post entries.

This program will update the book cost value of the equipment and create an invoice in accounts payable to pay for it. There will be NO amount in the flooring field on the piece of equipment. When the equipment is sold that book cost value will then be zeroed out.

Once all items are entered, press F9 to exit.

L - Long Term Liability - Flooring

Complete this screen. (Click on a field name for an overview. An asterisk (*) denotes required fields.)

FLOOR PLAN INFORMATION

Select ENTER or F10 to save and post entries.

This program will update the book cost and flooring value of the equipment. When the equipment is sold that book cost value will then be zeroed out. The flooring will be zeroed out when you post pins discounts etc to it and when you pay it through creating an accounts payable invoice or quick check.

Once all items are entered, press F9 to exit.

A - Add Equipment Without Posting

Function Key Explanations |

|

|

|

View a list of existing data |

|

|

Copy Equipment to another stock number |

|

|

Exclusive Search |

|

|

Enter or lookup Memo lines for equipment |

|

|

Edit Equipment information |

|

|

Allows you to assign options |

|

|

Full edit mode |

|

|

Allows you to view the photo manager for equipment |

|

|

Select Rate Code (third screen) |

|

|

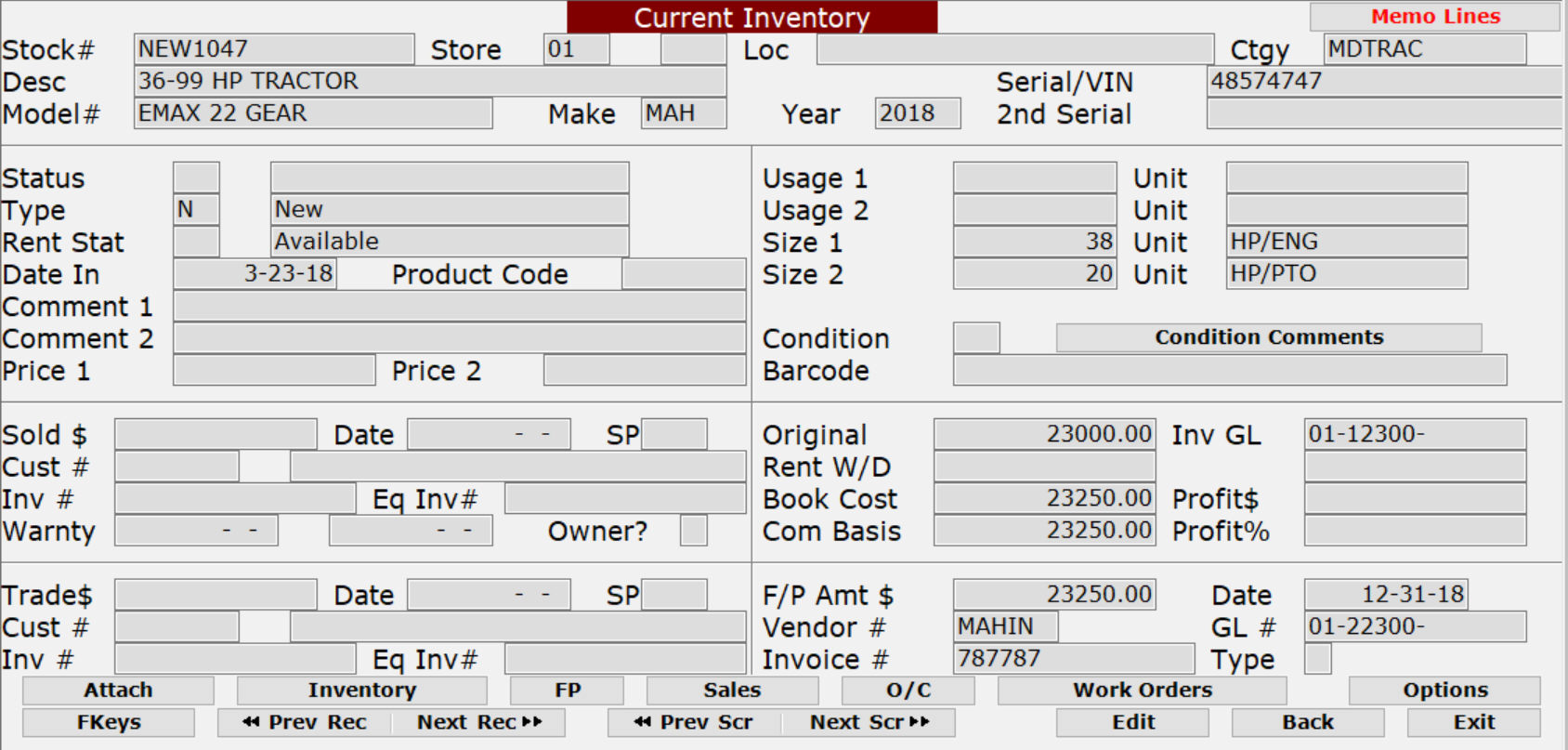

Allows you to view current inventory detail |

|

|

Previous Record |

|

|

Allows you to view current floor plan detail |

|

|

Next Record

|

|

|

Allows you to view current sales details

|

|

|

Allows you to view unposted work orders for equipment |

|

|

Scroll to previous screen |

|

|

Scroll to next screen

|

|

|

Clear field

|

|

|

Exit screen

Prints the Equipment Spec Sheet

|

Complete this screen. (Click on a field name for an overview. An asterisk (*) denotes required fields.)

Equipment>>Processing>>Equipment Processing>>Add equipment without processing.

You can click on the Add button or type in a stock number to add.

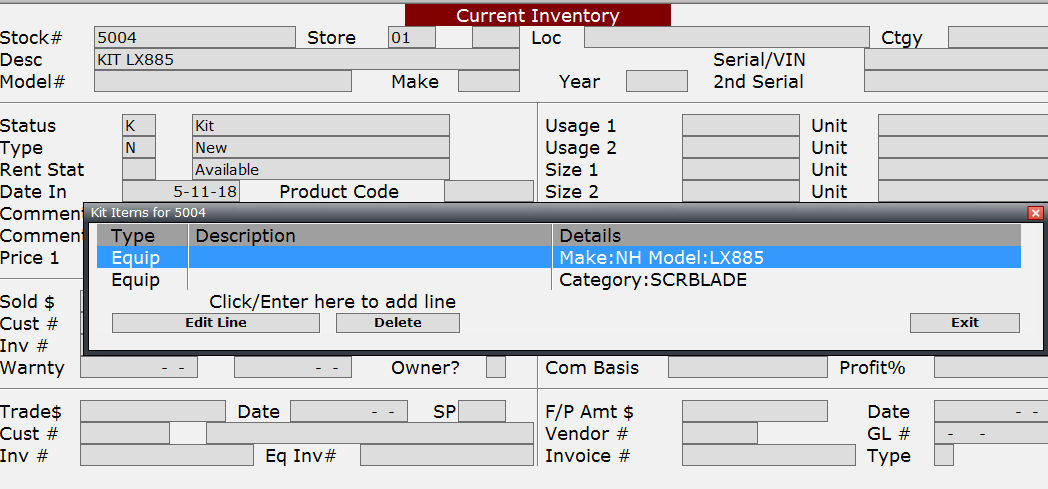

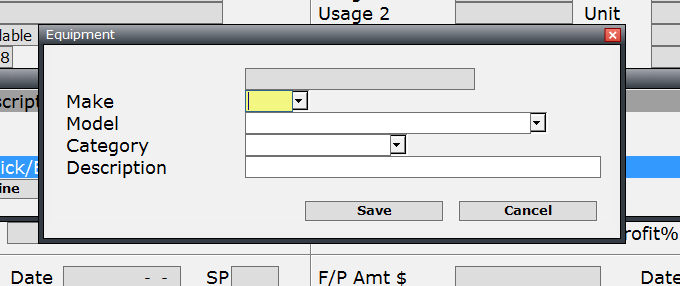

Click on kit

You can add equipment items that make up a kit

You must enter at least one field so you can search for that equipment item

Equipment Inventory Life Cycle

Upon arrival of the equipment, add the equipment item without posting. You will need to assign a stock number to this unit and enter its non-protected information at this time. The Book Cost, Commission Basis, and Floor Plan Due $ fields should remain blank at this time, but everything else can be added.

Once the vendor invoice arrives stating how much is owed on the floor plan:

You will need to choose how you are paying: I - Immediate Cash Disbursement, S - Short Term Liability-Accounts Payable, L - Long Term Liability-Flooring.

Enter the previously assigned stock number.

Complete all applicable fields. This sets the beginning value of the unit and records how much you owe on the floor plan.

|

You can change the Commission Basis, but everything that posts to the Book Cost will also affect the Commission Basis by the same amount. |

As work is done on the equipment, you will enter a work order showing the parts, labor, etc. that are "sold" to this equipment item. This will be an internal ticket and will have the stock number specified so the value of the invoice will be added to the book cost (accumulated cost) of the item when the invoice posts. There can be any number of these invoices, before and after the item is sold. As these invoices post, the book cost and commission basis fields will be changed by the amount of the invoice.

When the sale is final and the daily posting option is taken, the entries completed will reduce the book cost to zero and move it's last value to $ VALUE AT SALE and the cost of goods sold account (i.e. 42000, 42300, 42500, etc). The commission basis is reduced by this amount but may have a balance remaining if you adjusted it at any time. Any remaining balance in this field is ignored by the system.

When any payments are made to reduce the floor plan you can either:

Add an Accounts Payable invoice and pay it off through Accounts Payable.

Use the Cash Disbursements in the General Ledger program to do the same thing. The "expense" account for this invoice is the floor plan account (ex. 22000, 22300, 22500, etc) and the value is the actual amount you will be using for the check.

Click here for more details on the equipment settlement process.

Click here for equipment settlement examples.

When an Equipment Item is sold the dealer must, at some point, settle for that unit. This process cancels the remaining debt to/from the manufacturer and completes the life cycle of that unit. This process has some flexibility in which the order of events can occur, but all events must be completed before the settlement is complete. The steps below cover the majority of settlement types and provide a pattern for the rest.

PIN, DSA and discounts There are many incentives that the manufacturers often give to dealers that have the effect of reducing the cost to the dealer for the equipment item that was sold. These discounts apply based on sales date, total sales, and/or anything else the manufacturer designates. This information is known to the dealer at the time of the sale, so they should be able to record the discounts at this time. These amounts are recorded separately for proper tracking and contain a pair of journal entries per amount. These entries include a debit to the floor plan account and a credit to the book cost account for that equipment item. This can be done by Equipment>>Processing>>Equipment receipting>>Long Term Liability Flooring Enter in the stock number, up arrow in the description field and change to say PIN, DSA or Discount. Enter in the amount as a negative. If the discount is $200 enter the amount as -200.00 Press F10 to post.

Equipment Sales Ticket Once the discounts are entered, the equipment sales ticket can be recorded into the computer. When the equipment item is sold, a manual sales ticket (sometimes called a Purchase Agreement) is created to record the sale on paper for the customer's signature agreement. The terms and conditions of the sale are determined at this time, including the value of trade-in units. This process will be done through the over the counter invoicing program. It is very important that what goes to the contract amount is what is truly the contract amount.

Recording the Receipt/Outlay of Final Payment When the sale is completed, it often includes a "contract transit' which, in effect,sells the customer debt to the manufacturer and is removed from the dealer's debt to the manufacturer. When the net amount owed is greater than this contract amount, the dealer will either send a check or make an ACH payment and record it through the Cash disbursements program. If the net amount is owed is less than the contract amount, the dealer will receive a check or an electronic funds transfer for the same amount and record it through cash receipts. You must know the floor plan due amount. The floor plan due amount is found merely by looking up the equipment item in the master file or sales history (F8) program and reading the value on the screen. If the floor plan due is less than the contract in transit amount you will go to the cash receipts program. G/L Menu>>Processing>>Cash Receipts; SCREEN 1: This screen will be used to record the amount of the check or credit that was received, which should be the difference between the floor plan due $ and the contract in transit amount. The trial balance at the bottom right of the screen will show a debit balance. SCREEN 2: This screen will be used to clear the contract in transit amount. The G/L account to is 10700 and the amount will be entered as a CREDIT value. The trail balance at the bottom right of the screen will wither show a CREDIT balance or will be zero. The next line will be used to pay the floor plan due to zero, if this field is not zero the G/L account to use is 22000, 22100, 22300, 225000 and a stock number is required and the amount will be entered as a DEBIT value. If there was a used equipment payoff, then the account utilized for payoff's will be used. The amount will be entered as a DEBIT value. The trial balance at the bottom right if the screen will show either a DEBIT balance or will be zero. This should bring the trial balance amount at the bottom right of the screen to zero. Press F10 and that will post your work. If the floor plan due is greater than the contract in transit amount you will go to the cash disbursements program. G/L Menu>>Processing>>Cash Disbursements; This program is used if the Floor Plan Due $ is GREATER than the Contract in Transit Amount, so the dealer will pay the difference through ESS. SCREEN 1: This screen will be used to record the amount to be paid, which should be the difference between the Floor Plan Due $ and the Contract in Transit Amount. Pressing ENTER when finished will move to the second screen. The TRIAL BALANCE at the bottom right of the screen will show a CREDIT balance. SCREEN 2: This screen will be used to pay the Floor Plan Due $ to zero. The G/L Account to use is 22000, 22100, 22300 or 22500, a stock number is required and the amount will be entered as a DEBIT value. The TRIAL BALANCE at the bottom right of the screen will show either a DEBIT balance or will be zero. If there was a Contract in Transit Amount on the ticket, then the 10700 G/L account will be used. The amount will be entered as a CREDIT value. Pressing ENTER when finished will bring the TRIAL BALANCE amount at the bottom of the screen to zero. You may print a check or ACH and then F10 to post or just press F10 to post.

The following are examples of the settlement process starting from a simple example and proceeding to the more advanced examples.